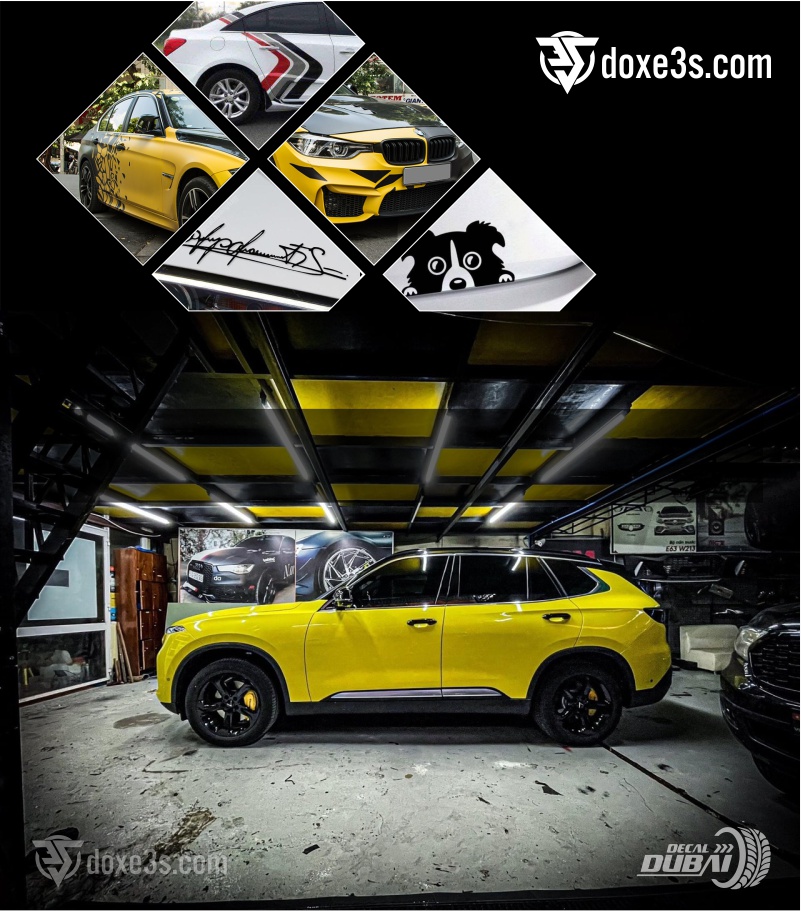

Dự án đã triển khai

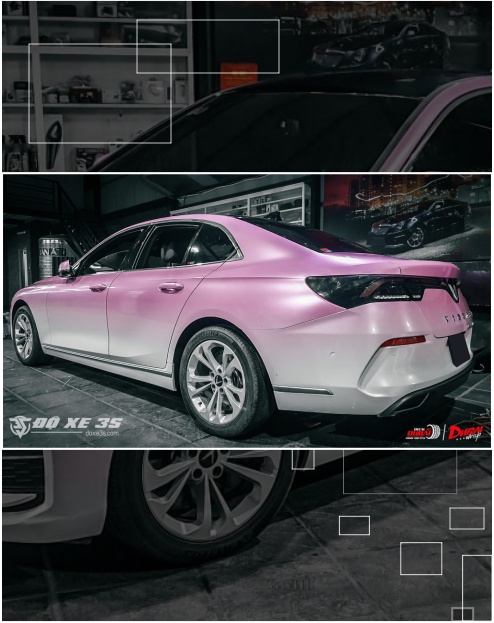

Dán đổi màu xe ô tô VinFast Lux A | Tone màu Trắng Hồng phong cách

VinFast Lux A là mẫu xe rất phù hợp để thể hiện nhiều ý tưởng độ đẽo. Dán đổi màu xe ô tô VinFast Lux A được nhiều người sở hữu quan tâm. Đặc biệt là người dùng cá...

Chi tiết >>Danh Mục Sản phẩm

Nâng cấp OPTION cho VinFast Fadil

Mình từng ngần ngại khi có quá nhiều bạn Sale tư vấn lan man không cần thiết về các OPTION nâng cấp cho Fadil. Cho đến khi sử dụng dịch vụ của DOXE3S. Các bạn tư vấn thực sự nhiệt tình, đúng nhu cầu, đủ tiện nghi, đề xuất các giải pháp nâng cấp phụ kiện không bị thừa thãi - hợp lý trong tầm ngân sách của mình. Cám ơn các bạn!

Anh Tuấn - Chủ xe Fadil ( Cầu Giấy )

Tư vấn nâng cấp chìa khóa thông minh cho Camry 2015

Nhà mình có 2 chiếc xe. Một chiếc Camry - một chiếc Lux A. Mình quen sử dụng chìa khóa Startstop. Nhưng thật bất tiện khi chiếc Camry của mình không có OPTION này. Mình tham khảo nhiều đơn vị lắm. Nhưng DOXE3S cho mình cảm giác yên tâm về mọi thứ. Từ kỹ thuật triển khai chuyên môn - tới chất lượng sản phẩm & giá thành. Mình đã sử dụng hệ thống Smartkey Karpro được 1 năm rồi. Mình sẽ Feedback các bạn sớm nhất.

Anh Đinh Đại Bảo - Chủ xe Camry (Nam Định)

Hợp tác phát triển với TEAM SALE ngành xe hơi

Nói thật. Mình rất ngại giới thiệu khách hàng của mình tới những đơn vị bán chuyên. Cho đến khi hợp tác cộng hưởng với DOXE3S. Mình hoàn toàn yên tâm. Các bạn rất chu đáo - cẩn thận - tư vấn tới khách hàng chung một cách có tâm - Không vụ lợi & làm hài lòng tuyệt đối khách hàng của mình. Mình sẽ tiếp tục ủng hộ và giới thiệu khách hàng tới DOXE3S.

Anh Thế Cao (SALE bán lẻ VINFAST)

Triển khai Nâng cấp ánh sáng

Trước kia mình từng giữ nhiều vị trí quản lý Kỹ Thuật quan trọng tại các trung tâm độ xe từ Hà Nội đến TPHCM. Mình đã gắn bó với DOXE3S từ năm 2019 đến nay. Cảm thấy môi trường ở đây trẻ trung, năng động, anh em làm việc bằng sự nhiệt huyết của tuổi trẻ. Môi trường thực sự tốt để bản thân được cống hiến hết mình cho đam mê. Cám ơn DOXE3S.

Tuấn Trần ( KTV DOXE3S - 8 Năm Kinh Nhiệm)